1. Introduction

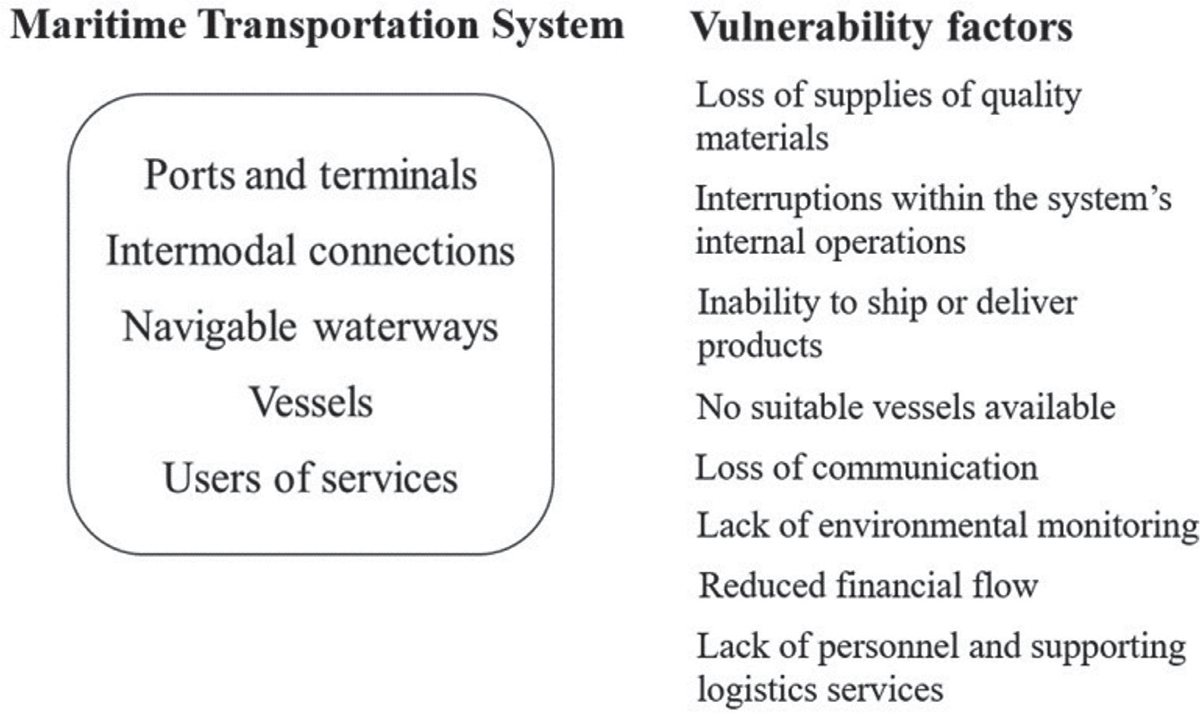

A maritime transportation system consists of seaports and terminals, intermodal connections, navigable waterways, vessels, and users.1 All factors and actors involved in the various activities of the transportation system must act in an integrated and coordinated manner to ensure efficient, effective, sustainable, and environmentally friendly operations. Understanding the interconnections of all the components of the system allows for the identification of not only operational risks but also systemic vulnerabilities and weaknesses that, when coupled with sudden stresses, could cause major inefficiencies or failures in operation.2 A “vulnerability” is here defined as a property of a transportation system that may weaken or limit its ability to endure, handle, and survive threats and disruptive events that originate both within and outside the system.3 The identification of vulnerabilities is an essential step in enhancing the resilience of the transportation system,4 yet research on vulnerabilities in maritime transportation systems is very limited.5 Although stakeholders in maritime transportation may have a solid awareness of frequent operational risks,6 there is a lack of awareness of systemic vulnerabilities as well as methods for addressing and planning for low-frequency, yet high-impact, disruption scenarios. In understanding and planning for such risks, the maritime transportation system needs to be understood as being part of a larger industrial system, with ripple effects spreading to the greater economy leading to wider disruptions.7

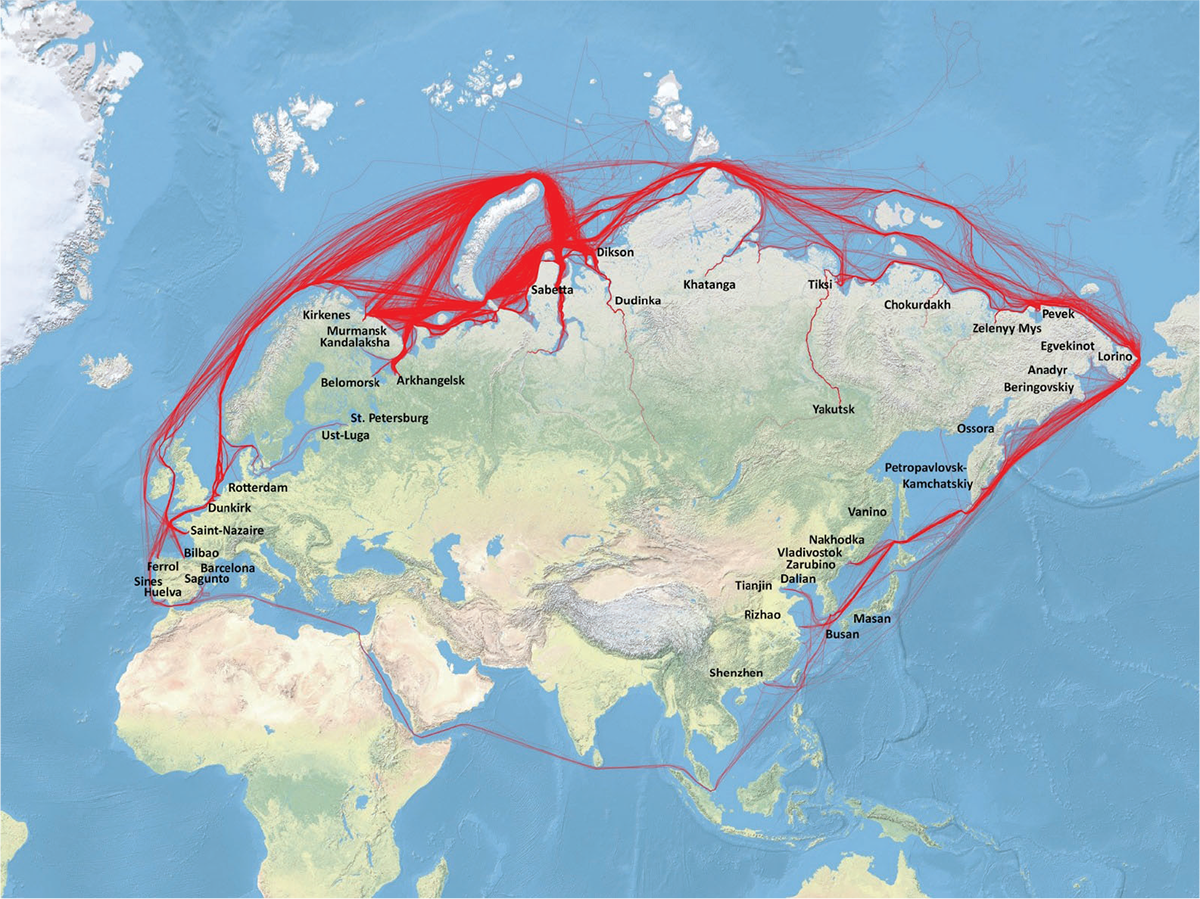

This article uses the maritime transportation system of the Northern Sea Route (NSR) along the northern coast of Russia (Figure 1) as a case study for a vulnerability analysis. The article analyses which vulnerabilities are currently prevalent in the NSR transportation system, both due to prior infrastructural deficiencies and more recently as the result of Western sanctions on Russia, and which negative consequences or failures are likely to occur that will impact the transportation system in the coming years. Such a study has not been done,8 though several previous studies have identified and discussed risk factors for maritime operations in the Arctic.9 Only those vulnerabilities that can severely impact the functionality of the NSR are analysed and discussed. Those are vulnerabilities that can make the transport system ineffective, impact shipping safety, and cause irreversible harm to the marine environment.

Shipping activities and cargo volumes have rapidly increased on the NSR over the past several years, in line with the development of large extractive projects in the Russian Arctic and cooperation with a large group of Western companies.10 Over many years before the Ukraine War began, Russia had become highly dependent on Western companies for critical technical supplies and support in its Arctic resource development. At the time, it was considered quite natural that Western energy and shipping companies would be involved in Russian Arctic energy projects as Russia had been supplying Europe with oil and gas from Western Siberia and the Arctic via pipelines for several decades, as well as more recently via maritime shipping.11 This cooperation between Western and Russian companies led to an unprecedented, rapid and large-scale industrial expansion in the remote Russian Arctic.12 Without extensive involvement by Western companies, this industrial expansion would likely have been impossible.

The article addresses two research questions: What are the current vulnerabilities of the NSR maritime transportation system, and will these vulnerabilities continue to impact its future development? And, what is the future outlook for shipping on the NSR and what are the implications for Arctic policy? The article is structured as follows: Section 2 describes the methodology; Sections 3–10 provide analyses of several vulnerabilities of the NSR maritime transportation system and their possible impacts; Section 11 discusses the outlook for the future development of the NSR transportation system and implications for Arctic policy, and Section 12 presents the main conclusion.

Figure 1. Map of NSR shipping tracks in 2022 based on AIS data. The total number of voyages was 2,994, made by 314 unique vessels. A voyage on the NSR is a voyage that originates from within the NSR, arrives in the NSR area, or transits the NSR. (Source: CHNL Information Office)

2. Methodology

Area of study. The area of study is the Northern Sea Route (NSR), defined by Russian law13 as the water area along the northern coast of Russia extending from the meridian of Cape Zhelaniya along the east coast of the Novaya Zemlya Archipelago (the entrance to the Kara Sea) to the Line of Maritime Demarcation between Russia and the USA and Cape Dezhnev in the Bering Strait. The length of this area from west to east is ca. 5,600 kilometres. The NSR extends 200 nautical miles from the coast and includes Russian internal waters, territorial sea, contiguous zone, and exclusive economic zone. Russia’s control over the NSR is based on both historical grounds14 and Article 234 of the United Nations Convention on the Law of the Sea (UNCLOS), which provides a coastal state with extended rights to enforce regulations in ice-covered areas. Russia’s interpretation of these rights is disputed by some states, including the USA, but is accepted in general by the international shipping community.

Methodology. The theoretical framework of this study is based on the principles of supply chain risk management,15 with a main focus on the vulnerability assessment of maritime operations. Several vulnerabilities are known to occur with low frequency but have the potential for having highly disruptive impacts on maritime transportation systems when they occur. The vulnerability factors used in this study are those outlined by Berle et al. (2011),16 based on consultation with a large group of maritime stakeholders17 who were asked to select which events would greatly impact the functioning of their maritime transportation systems. The stakeholders gave the highest risk rating to the potential loss of supplies of quality materials (e.g. supplier fails or cannot deliver), followed by interruptions within the system’s internal operations (e.g. power failure, machine breakdown, fires). Other vulnerabilities given high risk ratings by stakeholders included loss of communication and inability to ship or deliver products (no transportation possible, ports closed, land-based connections blocked). Other possible vulnerabilities included reduced financial flow (e.g. lack of access to capital, liquidity, and revenue, financial crises, drop in customer demand, new competitors) and a lack of personnel and supporting services (e.g., due to mass illness/pandemic or war). These vulnerabilities are presented in Figure 2. Two additional vulnerability factors not included in Berle et al. (2011) are suggested in this study based on their significance in Arctic regions, namely a lack of environmental monitoring (of sea ice in particular) and a lack of availability of suitable vessels (resulting in an inability to ship or deliver products). Failure mode, meanwhile, is defined as the loss of a key function or capability of the supply chain that reduces or eliminates the ability of the system to perform its mission. Berle et al. (2011) went on to discuss the significance of these potential vulnerabilities in general terms but did not apply this discussion to any particular maritime transportation system. These vulnerability factors are then used to analyse the vulnerabilities of the NSR maritime transportation system, and in particular those vulnerabilities with the greatest long-term impacts.

Data sources. The empirical data used in this study covers the period from 2016 to 2022 and was obtained from the Centre for High North Logistics’ (CHNL’s) NSR Shipping Database, managed by the CHNL’s Information Office. The database is based on Automatic Identification System (AIS) data provided by the Canadian satellite company exactEarth. All vessels officially registered by Russian governmental sources as working on the NSR each year were analysed and the details of their voyages were recorded. Several types of data were extracted from the datasets to evaluate yearly variations in shipping on the NSR over the study period. The vessel data allowed for a quantification of yearly changes in vessel characteristics, such as vessel type and ice class. Similarly, yearly voyage data were used to quantify changes in the times and dates of voyages, origins and destinations of voyages, and need for icebreaker assistance. Information on the ages of vessels came from the Clarkson World Fleet Register. In addition to academic literature, various other sources were used to clarify the nature of various shipping activities, including ship company websites, maritime newsletters, trade journals, governmental websites, and press releases.

Figure 2. Vulnerabilities impacting operations within a maritime transportation system (based on Berle et al. (2011)18

3. Loss of supplies of quality materials

Western countries have placed sanctions on technologies used in the construction of energy plants and terminals in Russia, including specialised high ice-class cargo carriers. Sanctions also include critical supplies19 needed for maintenance and replacement of faulty technical components for existing energy plants and various oil and gas field operations built with Western technology.20 The lack of access to critical supplies is likely to become a major problem for Russia’s resource developers within a few years and to impact both energy production and operational safety, leading to interruptions or breakdowns of key plant and terminal operations. Prior to the introduction of the current sanctions, Russian energy and transport authorities were not known for putting emphasis on maintaining and upgrading existing power and transport infrastructure in the Arctic or elsewhere in Russia.21 Though project delays are evident, President Putin has ordered that Russian Arctic development must not be postponed because of a lack of Western technology, stressing that alternative measures must be found.22 Nevertheless, Russian resource developer Novatek was forced to delay its new Arctic LNG-2 project and to introduce major modifications to the original designs due to a lack of Western technical components, impacting the plant’s production capabilities.23

It is difficult to predict how successful Russia will be in developing substitutes for key technologies and logistics services that until now have been provided by Western companies without jeopardising safety and environmental protection in the Arctic. Future technical support and equipment will need to come from Russia’s own domestic companies and companies from politically supportive countries.24 However, these companies lack the technical capabilities and experience to fully replace all the Western companies that have been involved in Russian Arctic energy development, which are world leaders in their respective fields of operation. Russia previously tried to develop its own LNG liquefaction technology as part of the Yamal LNG (as an added fourth liquefaction train) without much success. The Yamal LNG plant was Russia’s second LNG plant to commence operation, following the Sakhalin-2 LNG plant in the Russian Far East, which started production in 2009, and was also developed by Western companies.

Western equipment and machinery could also be acquired on behalf of Russia and then imported to Russia by countries that do not participate in imposing sanctions on Russia. Declarations of China–Russian cooperation in Arctic maritime development have increased during the past years, and more so after the start of the Ukraine War, but there are still policy contradictions25 and uncertainty about this cooperation going forward. The sale of equipment to Russian companies is another matter. Though China does not support Western sanctions on Russia, it is weary of jeopardising trade relations with its most important trading partners, the US and the EU. Meanwhile, even if such imports become more commonplace, the lack of onsite knowledge and maintenance will still be an issue, and imports of replacement parts from supportive countries are likely to take a long time to arrive in the Russian Arctic. In the meantime, both plant and terminal operations would be affected, jeopardising operational safety and negatively impacting the Arctic environment.

4. Interruptions within the system’s internal operations

Shipping on the NSR relies on two distinct maritime infrastructure systems that differ vastly in scale, effectiveness, and reliability. The first is composed of recently constructed state ports and company-operated terminals for the export of Arctic natural resources, and initially also the import of plant equipment and machinery. The second system is made up of older community ports26 supplying remote Arctic settlements with food, fuel, and consumer goods.

Frequent arrivals and departures of tankers27 at export terminals in heavy ice conditions during the winter–spring season can create challenging operational conditions that can lead to accidents. Oil spills in ports can halt transport within the port area while clean-up operations are ongoing. Fires within energy plants can halt both production and transportation.28 There are also several depth restrictions on official shipping lanes through Russia’s coastal waters. Larger vessels servicing extractive industries need to sail much further away from the coast and avoid shallower waters close to archipelagos and coastal straits. Limited bathymetric studies have been done to map out higher-latitude shipping lanes along the NSR,29 but several scheduled surveys were planned for 2019–2024. At the entrance to Ob Bay there is only one narrow shipping channel leading to the export terminals further south. Vessels need to carefully follow the narrow shipping channel, and if they deviate too far from its centre line (e.g., when two tankers going in opposite directions need to pass) during bad weather and under heavy ice conditions, they face the danger of grounding.30

Extensive dredging of sediments is required to keep sailing lanes open for larger tankers to navigate to and from export terminals on the NSR. Large amounts of alluvial sediments are washed out to sea from the watersheds of Siberian rivers during the spring thaw, making dredging an annual necessity. These dredging operations, which can only take place during the summer–autumn season, are time-consuming and require specialised dredgers and a support fleet. The subsea sediments are frozen (permafrost), requiring vessels to first break up the frozen sediments into smaller pieces to be suctioned up to the surface onto support vessels31 for removal and eventual dumping into the river or bay at predetermined locations away from shipping lanes. This process causes harm to the delicate local Arctic aquatic ecosystem. For essentially all of this dredging work, Russia has been dependent on a fleet of large and powerful European dredgers.32 Though Russia has also been operating several dredgers on the NSR, they have much lower capacities compared to the European dredgers. Now that Russia no longer has access to the European fleet of large dredgers, it plans to build up its own fleet.33 The loss of access to Western dredgers comes at the same time as two new terminal projects are being developed on the coast of the Taimyr Peninsula in the Kara Sea.34 The lack of sufficient dredging can have serious operational and environmental consequences, leading to the closure of narrow shipping channels by foundered vessels and the increased likelihood of serious oil spills in icy waters. As building up Russia’s own dredging fleet is likely to take some time, the ongoing lack of dredging capacity will continue to impact the pace of future resource development and the safety of shipping in coastal waters.

Unlike the advanced terminal infrastructure devoted to transporting Russia’s hydrocarbon resources, maritime infrastructure for the domestic market consists of older, lower-capacity ports constructed during the Soviet Era, which are in desperate need of modernisation and upgrades.35 These ports have experienced infrastructure damage as a result of thawing permafrost36 in recent decades. The domestic ports are serviced during the summer–autumn season each year by a large fleet of older Russian general cargo vessels and oil tankers (2,000 deadweight tonnes). To reach many settlements along the Siberian rivers, cargo needs to be reloaded onto barges or river vessels with smaller drafts, which makes for complicated logistics. Foreign vessels are prohibited from entering these community ports. The locations of the Arctic settlements and their ports were initially based on strategic grounds.37 If a natural resource extraction project is now located close to a coastal or river settlement, then the transport and social infrastructure of the settlement is more likely to be upgraded and modernised. If not, then the future outlook of such remote communities in the Russian Arctic is likely to be very grim. Arctic ports considered for upgrades also increasingly include ports of military/security significance for Russia38 as well as ports of navigational significance along the NSR (e.g., Pevek39).

One of the main components of any maritime transportation system is effective intermodal sea–land connections.40 However, the NSR generally lacks sufficient transport infrastructure connecting the Arctic coastal regions with areas further south in Siberia. Also, there are no east–west road or rail connections between coastal regions on the NSR. This makes the Siberian rivers, which flow north into the Arctic Ocean, the only transport connection between the Arctic coast and the Siberian hinterland. These rivers are only ice-free for about 3–4 months of the year, which limits their overall effectiveness as transport corridors, although they can also be used during the winter–spring as ice roads facilitating the transport of local goods between river towns. Resource developers planning the development of Arctic projects need to build their own support infrastructure for transporting materials and industrial equipment to the Arctic for the construction of extractive fields, and for the regular transport of raw material from the extractive fields to export terminals.41 Intermodal transport connections increase the significance of ports and terminals to that of major export hubs. The presence of multiple intermodal connections also creates redundancy; even if one transport link is shut down temporarily or permanently, other transport connections to resources will still be open.

5. Inability to ship or deliver products

Another major limitation of the NSR as a transportation system is the fact that only the western part of the route is currently operational year-round42 (Figure 1). Shipping during the winter–spring season is only made possible by highly specialised and powerful Arc7 icebreaking carriers, or with extensive support from powerful Russian nuclear icebreakers for vessels of intermediate ice-classes (Arc4-5). Sea ice conditions during winter–spring in the eastern and the main parts of the NSR, along the Laptev Sea, the East Siberian Sea, and the Chukchi Sea, are much more challenging. Though the NSR could be navigable in the winter–spring eastwards to the Asian Pacific in the near future, from a financial perspective this is likely to be a viable option only for the transport of high-demand and high-value commodities (LNG, gas condensate, crude oil, and iron ore) in substantial volumes due to the high investment needed to construct high ice-class vessels43 and the costs of icebreaker assistance. Resource developers and their shipping companies are reluctant to build such vessels unless they can be put into regular use on a year-round basis. For other users with less profitable cargo, the NSR will continue to be a seasonal route only open during summer–autumn, and therefore of limited international significance.

Year-round large-scale container shipping via the NSR between the European and Asian markets would be a prerequisite for the NSR’s integration into the global transportation system. Although international transit shipping on the NSR (i.e., shipping between two non-Russian ports via the NSR) began in 2010,44 regular shipping with containerised goods has not yet materialised in the summer–autumn.45 Container shipping in the winter–spring would also require powerful Arc7 icebreaking containerships and assistance from nuclear icebreakers. Though a prototype Arc7 container vessel has been designed,46 its construction and operational costs would be much higher than for conventional container vessels47 sailing on southern shipping routes. Whereas high ice-class vessels are the only option for transporting commodities out of the remote parts of the Arctic during the winter–spring, container shipping has well-established southern routes between Europe and Asia, with several intermediate ports for cargo loading or unloading along them, keeping the cargo load factor high (but increasing the ship transit time). International container shipping companies are reluctant to alter long-established logistics operations on the traditional route through the Suez Canal for a seasonal one-stop Arctic shuttle route. This is despite current Red Sea attacks that have at least temporarily increased shipping costs on the Suez Route.

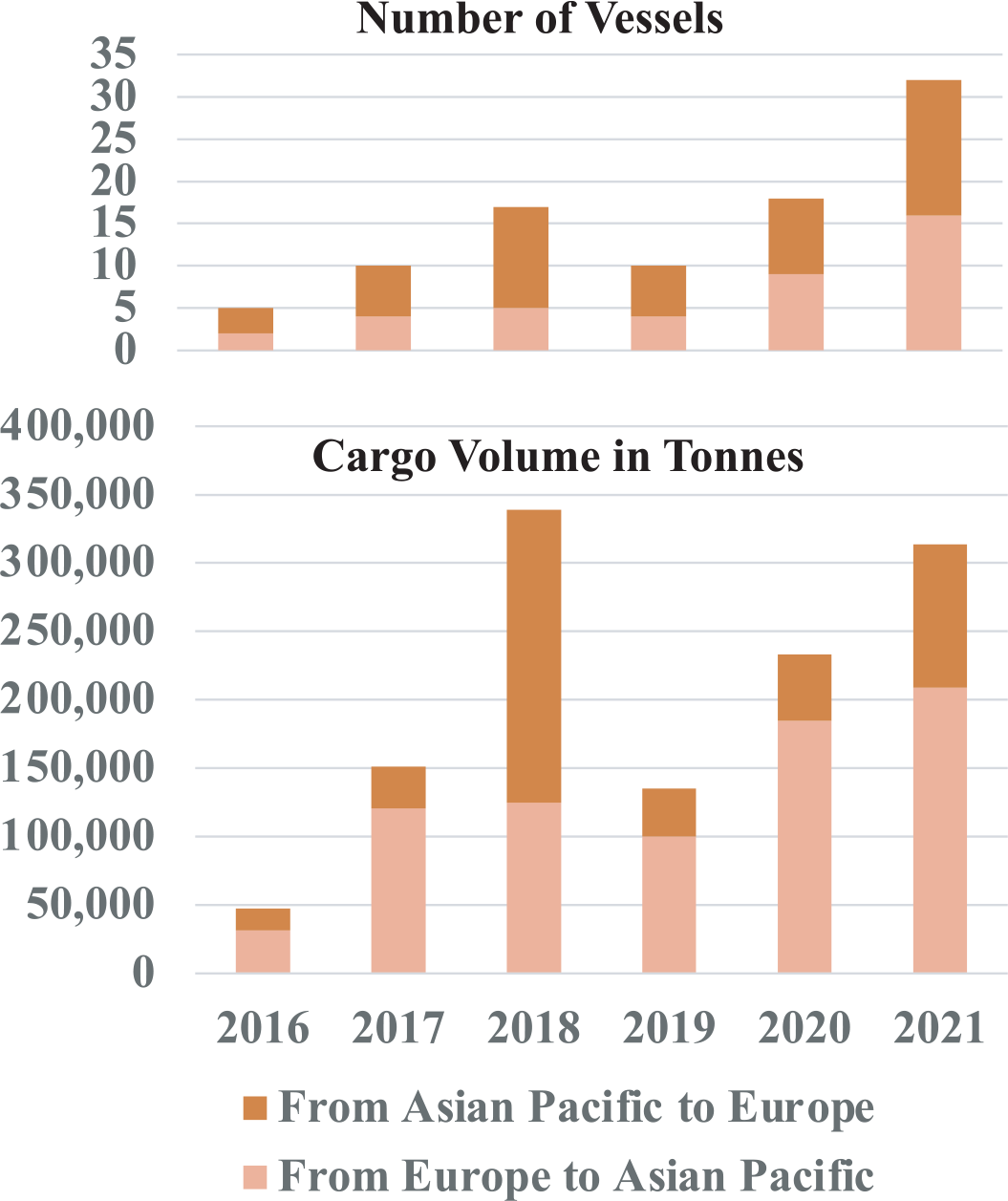

What has developed on the NSR instead of container shipping was the shipment, during the summer–autumn season, of general cargo and project cargo on general cargo vessels (also referred to as multi-purpose vessels) between NE Asia (mainly China, but also South Korea and Japan) and NW Europe (mainly the Nordic countries). Such vessels are suitable for transporting multiple types of cargo in the same shipment. The number of vessels and cargo volumes on the Asia–Europe route have stayed consistently low each year (Figure 3), and shipments stopped altogether in 2022 as a result of Russia’s invasion of Ukraine. The shippers have mainly been the Chinese state-owned COSCO Shipping Specialized Carriers, including several vessels from German heavy-lift shipping companies, some of which were registered at the time in the Clarkson World Fleet Registry as being owned by Chinese companies. COSCO started to experiment with transporting general cargo via the NSR in 2016, in support of the Chinese government’s White Paper on Arctic Policy, published in January 2018.48 It is likely that these efforts were, from the start, politically motivated and not based on financial or commercial reasons. Several of the largest international container shipping companies made a statement in 2018 that they did not intend to begin using the NSR for container shipping. This included companies which own popular consumer brands. In the aftermath of Russia’s invasion of Ukraine, COSCO stopped NSR transports in 2022 and 2023, likely based on both feared reputational consequences and the unwillingness of European ports to receive cargo that had been shipped through Russia’s NSR waters.

Even in a post-war scenario, container shipping between Europe and Asia via the NSR is likely to provide limited financial benefits for Russia, and only in the form of some additional icebreaker fees. It is also very unlikely, for security and military reasons, that the Russian government will support increased traffic of foreign vessels on the NSR that are only passing through between ports in Europe and Asia. Russia would also be responsible for providing emergency services to an increased fleet of transiting vessels, including refuge assistance and support for ships in distress, search and rescue operations, oil spill response, and salvage. Problematic for foreign shipping companies has been the fact that the fees to be paid to the Russian State in the case of accidental damages and pollution of the Russian Arctic marine environment by foreign vessels have so far been based on specific Russian methodologies and assessments that are not fully accepted by the global shipping community.49

Figure 3. Asia–Europe trade via the NSR in 2016–2021. No trade took place in 2022–2023

6. Lack of environmental monitoring

There is a lack of high-resolution satellite monitoring of the NSR. The accurate and timely forecasting of sea ice conditions is of paramount importance for the safety of navigation, and the lack of data required for such forecasting is a major vulnerability of the NSR transportation system as shipping is faced with severe challenges due to sea ice and interannual sea ice variability. Current short-term sea ice and weather predictions on the NSR provided by Russia are likely to be inaccurate and provide far from the needed near-real-time assessments of local sea ice conditions. Russia’s access to foreign satellite images is now restricted by international sanctions, placing even more limits on the data available to suggest different sailing tracks for ships on the NSR based on the most favourable sea ice conditions at the time. Foreign vessels on the NSR have needed to rely on non-Russian public or private ice-service providers that track ship movements and suggest paths through the ice based on available information. In an attempt to improve its satellite coverage, Russia has recently decided to partner with China to improve sea ice forecasts on the NSR.50

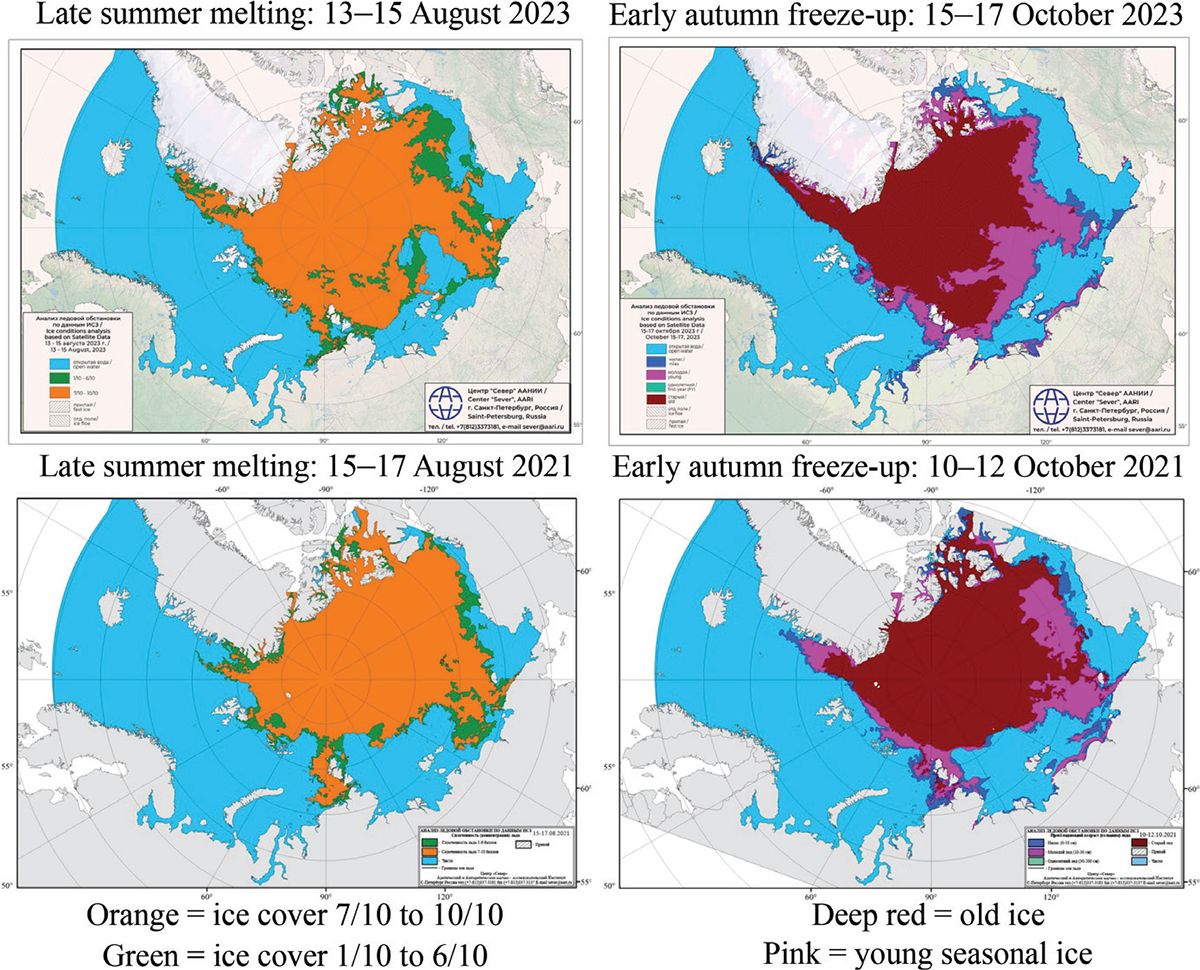

As a result of abrupt climate change and warming in the Arctic, conditions in the Arctic Ocean are increasingly dynamic and variable, with storms becoming more intense and frequent,51 making it difficult to predict sea ice evolution weeks or even days in advance. Interannual variability in both the distribution and the thickness of sea ice on the NSR can lead to unexpected and challenging navigational conditions. Multi-year sea ice from the higher latitudes can drift quickly into shipping lanes as it is blown by strong winds from the north. Though the thickness of level sea ice along shipping lanes on NSR in the winter–spring ranges between 30 and 200 cm,52 large fields of land-fast ice can clog up straits used for navigation, and pressurised ice flows with several metre-thick ice ridges and fields of hummocky ice can develop on shipping lanes, impacting vessels’ safety. Calving icebergs from disintegrating glaciers also represent a significant hazard to maritime safety on the NSR.

Large ice fields on shipping lanes that survive melting during the summer months (July–September) can become engulfed in the early-autumn freeze-up of coastal seas in October, particularly in the Laptev and the East Siberian Seas, leading to dangerous sailing conditions at the end of the summer–autumn shipping season. These ice fields then develop into harder and thicker second-year ice and continue to cause navigational challenges in the winter–spring of the following year. This occurred in late October and early November 2021, when several transiting foreign vessels en route to China, as well as Russian vessels heading to the port of Pevek, became stuck in thick ice for several days, and some for several weeks (Figure 4). Though Russian authorities were aware that summer melting had occurred late on the NSR, with large ice fields still present in July and August, this early freeze-up had not been foreseen and came as a surprise.53 Even if foreign shipping companies (and their insurers) had insisted on icebreaker escort beforehand for safety reasons this late in the summer–autumn season, Russian icebreakers were unavailable at the time as they were still undergoing their annual summer–autumn maintenance in Murmansk. This caused long delays in freeing ice-bound cargo vessels. According to Russian sources,54 very challenging sea ice conditions were also observed on the NSR in the winter–spring (January–June) of 2018 and 2023, with large fields of second-year ice extending into the shipping lanes in both the Laptev Sea and East Siberian Sea, blocking access.

Figure 4. Challenges due to sea ice and interannual sea ice variability on the NSR (Source: AARI)

7. Loss of communication

It is important for ships operating on the NSR to have access to high-speed broadband communication and be able to receive detailed warnings and sailing directions. Crews must be able to access digital ice maps and satellite imagery to help determine the best sailing route through the ice. Because Russia cannot provide such information, it has instead relied on its powerful nuclear icebreakers to escort Russian and foreign vessels, providing onsite ice navigation information through radio channels. However, as mentioned above, Russia has decided to partner with China to improve satellite communications on the NSR, and since April 2023, this partnership has also included a general agreement on maritime security cooperation.55

Norway, in cooperation with the UK’s satellite communication firm Inmarsat and several other partners, is working on the first circumpolar Arctic broadband communication platform, to be ready in 2024.56 However, this system will not be available to Russia. Russia has for several years been planning to launch its own constellation of Arctic monitoring and communication satellites, but this system has faced multiple delays.

8. No suitable vessels available

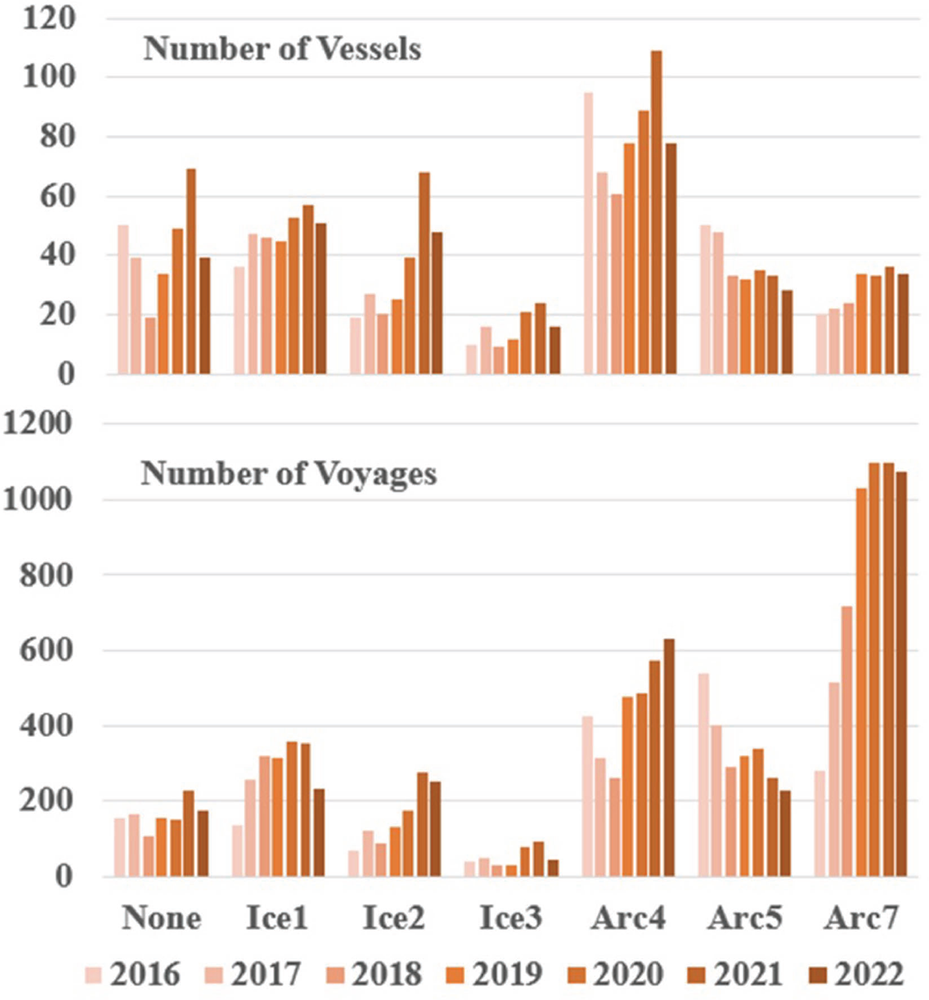

There is limited availability of ice-class vessels on the global shipping market for use on the NSR, including vessels in different segments and sizes. Though Russia is the largest operator of ice-class vessels, and in particular oil tankers and general cargo vessels, most of the vessels are of low to medium ice-class, suitable only for use during the summer–autumn season on the NSR (Figure 5).

The lack of higher ice-class vessels (Arc7) for use during the winter–spring on the NSR prompted the Russian government in September 2020 to modify its vessel ice-class requirements and allow the continued use of vessels with intermediate ice-classes (Arc4-5) during the winter–spring if escorted by nuclear icebreakers. Prior to this change, Arc4-5 vessels were not allowed to operate between 30 November and 1 July even with icebreaker escort, although ship traffic data suggests that several such vessels were sailing on the NSR during the winter–spring in 2016–2020. Due to more severe sea-ice conditions in winter–spring, vessels of lower ice-classes are several times more likely to become stuck in ice57 and require extensive icebreaker assistance, raising major concerns for shipping safety and environmental protection.

Figure 5. Ice-class of vessels operating on the NSR 2016–2022

To make things worse, in February 2018 Russia banned foreign vessels from transporting hydrocarbons on the NSR.58 As a result of this ban, Russia needed to build a large fleet of Arc7 shuttle carriers to serve several planned extraction projects along the NSR. But Western sanctions on the Russian shipbuilding sector in March 2022, together with sanctions on critical technologies for the construction of LNG tankers, made this task impossible. Instead, Russia will likely be forced to rely on Chinese shipyards to deliver the needed vessels.

Another concern is vessels which only have weak ice-strengthening (ICE1-3) or have no ice class at all (Figure 5). Such non-Arctic vessels are allowed to operate on the NSR between 1 July and 15 November if sea ice conditions are predicted to be “very favourable”. But, as discussed earlier, sea ice conditions can change quickly on the NSR, making such vessels very vulnerable, impacting shipping safety and increasing the risk of accidents and oil spills. Cargo vessels without ice-class or with only weak ice-strengthening sailing on the NSR include several types of vessels, such as oil tankers, LNG tankers, general cargo vessels, heavy-lift carriers, and dry bulk vessels. Russia started regular shipments of crude oil to Asia via the NSR on low to medium ice-class tankers in 2023 from storage terminals on the Kola Peninsula near Murmansk and near St. Petersburg in the Baltic Sea. Regular shipments of crude oil to Asia on non-ice-class tankers, escorted by nuclear icebreakers, are also being planned by Russian authorities, with one such shipment taking place in 2023. Shipments of crude oil to Asia will also increase significantly with the Vostok Oil project on the Taimyr Peninsula, expected to start production in 2024. The increased traffic of larger crude oil tankers of low ice classes on the NSR increases the probability of oil spills in Arctic waters, with severe consequences for the marine environment.

Despite the large number of vessels with no or low ice-classes, only 5–9% of NSR voyages during the summer–autumn season in 2016–2019 were escorted by Russian nuclear icebreakers, with the highest percentage being in 2016 (when escorted vessels included those carrying prefabricated LNG modules for the Yamal LNG plant). This percentage is likely to have been significantly lower in 2020–2023. To further promote the use of lower ice-class vessels and increase shipping activities on the NSR, the new navigational rules instituted in 2020 divided the NSR Water Area into 28 zones (instead of the previous 7), with different expectations for sea ice conditions and vessel ice-class requirements in each region.

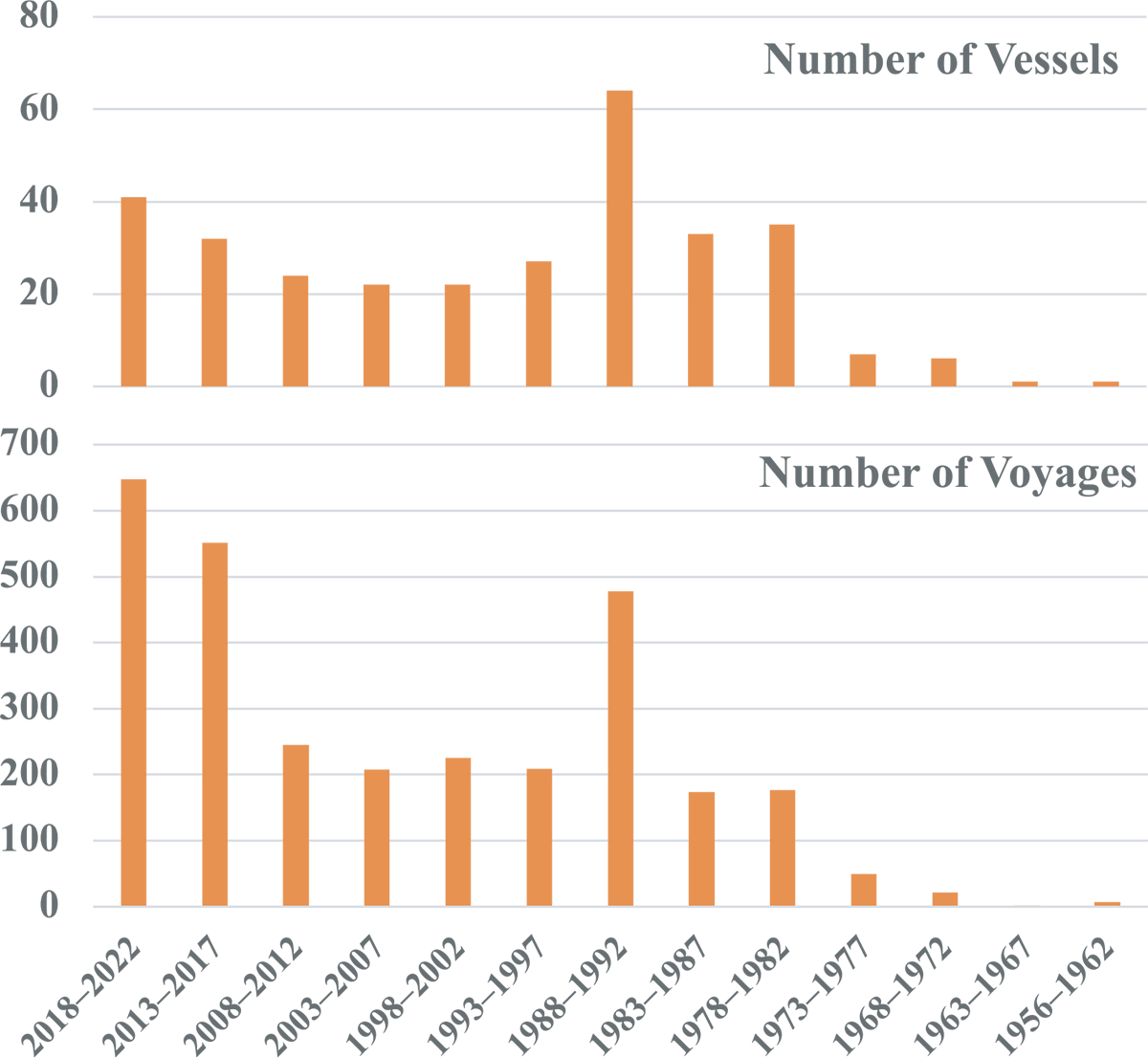

The majority of Russian cargo vessels operating on the NSR are old and have low gross tonnage. Vessels used in Russian domestic shipping were generally built 30–45 years ago (Figure 6) and have severely exceeded their expected service lives. These same vessels also have low to moderate ice-classes. The advanced age of these rusting tankers transporting heavy shipping oil and oil products in Arctic coastal waters increases the risk of accidents and oil spills.59 Despite these risks, these vessels continue to be classified and recertified for operation in Russian coastal waters by the Russian Shipping Registry. This will not encourage Russian shipping companies serving the domestic market to upgrade their vessels to meet international standards. Also, the general responsibilities for enforcement to ensure that vessels meet Polar Code requirements rests with the flag state, in this case also Russia.

Western tankers have transported most of the LNG and all of the gas condensate from the Yamal LNG plant, and initially also a large part of the crude oil from the Arctic Gate oil terminal to floating storage tanks near Murmansk. As discussed earlier, this included several other critical logistics services on the NSR performed by Western shipping companies for the Russian extractive industries.

Figure 6. The age (year of construction) of vessels on the NSR in 2022 arranged into 5-year groups. The foreign vessels on the NSR (servicing the Yamal LNG) all fall within the two most recent age groups: 2018–2022 (18 vessels) and 2013–2017 (10 vessels). All other vessels are Russian

9. Lack of personnel and supporting logistics services

Russian natural resource developers in the Arctic favour the shift (or fly-in/fly-out) method for their workers, who operate out of temporary residency camps. The shift labour settlement at the port of Sabetta on the Yamal Peninsula is designed for 3,500 workers to be onsite at any time, although it provides more than 20,000 full-time jobs and has no permanent residents.60 The shift labour in the Arctic is considered more convenient than the establishment of permanent communities by Russian resource developers as it requires less infrastructure (e.g. houses) for workers and allows workers to return to their homes at scheduled intervals and escape the extreme weather conditions in the Arctic. During the coronavirus pandemic, work schedules were extended for an additional two months61 as a result of mandatory quarantine. The vulnerability of the shift-labour method is its dependence on frequent flights bringing workers to and from the settlement area, which can easily be interrupted by abrupt changes in the Arctic weather, causing confusion in work schedules. Most shift-labour workers in the Russian Arctic are from other parts of Russia, but many also come from China, Turkey, and Central Asia, recruited by several contractors and subcontractors.

Western energy and technology companies pulling out of the Russian Arctic led to a loss of onsite personnel and expertise to provide scheduled maintenance repairs and uphold high operational and environmental standards, including monitoring the energy and transport system’s overall performance. Losing this expertise increases the possibility of interruptions or the breakdown of key plant and terminal operations. Western companies also provided a number of transport and logistics services in the Russian Arctic that quickly came to a halt after the start of the Ukraine War. These services included dredging by large, specialised dredgers, provision of supplies for offshore exploration, transport of large modules and other project cargo via heavy-lift carriers, and the services of Western ship classification societies and maritime insurance companies. The loss of these services, and of dredging services in particular, has greatly impacted the internal operations of the maritime transportation system and shipping safety.

10. Reduced financial flow

In the aftermath of the Russian invasion of Ukraine in February 2022, Western countries placed several economic sanctions on Russia, targeting its oil and coal exports in particular. Russia was also excluded from using the SWIFT banking system and access to Western loan institutions, and its gold reserves in Western banks were frozen. These financial restrictions, among others, together with the cost of Russia’s ongoing war in Ukraine, limited Russia’s access to capital for both ongoing projects and the maintenance of existing energy and transportation infrastructure on the NSR. Any available funds are likely to be used primarily for new energy projects to generate more revenue through the export of hydrocarbons, although future demand for the sanctioned Russian commodities is currently uncertain.

A possible hike in LNG prices has been a major concern for the EU, which has not (yet) put sanctions on LNG imports from Russia, but instead has diversified and increased imports from both the US and Norway. The US announced new economic sanctions on Russia in November 2023,62 specifically targeting Novatek’s Arctic LNG-2 project and the two floating LNG transshipment facilities near Murmansk and on the east coast of Kamchatka. The aim of these new sanctions was to limit Russia’s future LNG production without affecting the current supply (i.e. from the Yamal LNG). The timing of this latest round of sanctions seems to suggest that the US, in cooperation with the EU and other partners, believed that enough LNG supply was now available to meet global market demand, and thus reduced future Russian LNG imports would not lead to higher LNG global market prices. The latest US sanctions will block the sale, transport, and transhipment of LNG and gas condensate produced at the Arctic LNG-2 plant. These sanctions prompted the international owners63 that co-financed the project to declare force majeure as they would not be able to uphold the initially agreed long-term contracts to annually purchase a large portion of the LNG production. Novatek now needs to sell its sanctioned LNG on the spot market in Asia and elsewhere, offering substantial discounts – if they are able to acquire new LNG tankers to transport the commodity.

11. The future outlook for the NSR’s maritime transportation system

Despite hefty sanctions on Russia by Western countries following the Russian invasion of Ukraine in February 2022, Russia’s focus on Arctic resource extraction has not diminished. This can be explained by Russia’s substantial dependence on raw material exports, now mainly extracted within its Arctic region, to sustain its economy. As mentioned earlier, President Putin has ordered that Arctic extraction projects must not be delayed because of Western sanctions, demanding that alternative measures be found to keep Arctic development on course. As a result, the export of commodities on the NSR is projected to increase until 2035, with consequent increases in shipping activities. The Russian government’s new Arctic Development Plan to 2035, adopted on 4 August 2022, contains grand ambitions for the development of several new energy and mineral resource extraction projects and accompanying export terminals in the Arctic, to be supported by a large fleet of ice-class cargo vessels, icebreakers, and other support infrastructure.64

This projected resource development now needs to take place without Western technology, investments, expertise, services, and markets. The Western companies previously involved in Russia’s Arctic development are global technology leaders and experts in their respective fields of operation, and their contributions are not easily substituted or replaced. The Bank of Finland has referred to Russia’s loss of access to advanced technology as “reversed industrialisation”.65 Likely consequences include a reduction in operational and environmental standards, which will, over time, reduce operational safety and increase the likelihood of environmental accidents and system failures.

As is not uncommon during challenging times and war, environmental protection in the Russian Arctic and along the NSR is likely to be deprioritised. Both Russia’s newly amended Fundamentals of State Policy in the Arctic to 202366 and the updated version of the Russian Foreign Policy Concept67 downplay the significance of climate change and the need for environmental protection, instead highlighting national interests and the increased development of natural resource extraction. These two new documents leave little doubt that Russia no longer intends to be obliged by international regulations in the management of its Arctic, and rather move ahead exclusively based on national interests.

The NSR is therefore quickly developing into a Russian-only shipping corridor, as was the case in Soviet times when foreign vessels were largely prohibited from entering Russian Arctic waters. This benefits Russia in times of war, geopolitical tension, and regionalisation, as it allows Russia to control shipping over a vast territory year-round with the help of its powerful nuclear icebreakers. This is not the case along its other coastal seas, i.e., the Baltic Sea, the Black Sea, and the North Pacific, where Russia is surrounded by so-called “unfriendly nations”. A strong presence in the increasingly navigable Arctic Ocean is of key importance to Russia, not least when seen from the perspective of national security and Arctic militarisation. Russia updated its Marine Doctrine on 31 July 2022 with the Arctic coastal seas, the NSR, and the Arctic Shelf named as key priority areas vital for Russia’s economy and national security.

The Law of the Sea, which Russia ratified in 1997, does not allow Russia to exclude foreign vessels from transiting NSR waters outright, but Russia is likely to use different means to discourage future use by Western shipping companies. UNCLOS Article 234 does provide Russia with the right to manage shipping activities in its seasonally icy coastal seas and set specific navigational and reporting rules that ships must follow when sailing on the NSR. In light of the escalating confrontation between Russia and the West as a result of the Ukraine War, however, it is highly unlikely that Western commercial shipping companies will opt to use the NSR for international transit shipping between Europe and Asia any time soon. Meanwhile, instead of the relatively short shipping routes from Ob Bay and the Kara Sea to the European market, new markets for Russian commodities will now, and for the foreseeable future, require longer-distance shipping to East Asia (China), South Asia (India), Africa, and Latin America, with much greater transport times and costs compared to deliveries to European destinations.

Though China has not taken part in Western sanctions on Russia, as both Japan and South Korea have done, Chinese shipping company COSCO cancelled all of its scheduled Asia–Europe transits via the NSR in 2022, and again in 2023. This was likely due to political pressure resulting from the unwillingness of European nations to receive or deliver cargo through Russian NSR waters, along with China’s desire to shield a large and important shipping company from expected reputational consequences. It is not clear at this point if shipments on COSCO vessels on the NSR will resume at some later date.

Despite these cancellations, Russia is increasingly dependent on Chinese companies. Russia needs to restart regular container services at its ports in the Baltic Sea, the Black Sea, and the Far East, which had, before the Ukraine War, been serviced by several global container companies and logistics providers. The Russian container market therefore presents an opportunity for China to become an important service provider and increase its exports and market influence in Russia. A Chinese transport and logistics company (Torgmoll Group) which has been involved in constructing the China–Europe train network as part of China’s Belt and Road infrastructure project, has been given the additional responsibility by the Chinese government to develop a container route on the NSR. The newly established subsidiary company, New-New Container Line, will provide container services via the NSR between Chinese ports (e.g., Shanghai) and selected Russian ports (including St. Petersburg, Kaliningrad, and Arkhangelsk). Likely due to the short notice, the company, which has no prior maritime experience, acquired five second-hand vessels (built 1999–2012) at a low cost, mainly from German outfits previously providing shipping services in the Baltic Sea. In 2023, these vessels made a handful of voyages on the NSR between Chinese and Russian ports.

Russia will also be dependent on Chinese shipyards to help with the construction of its future Arctic fleet of crude oil, gas condensate, and LNG tankers, along with dry bulk carriers for the transport of coal and iron ore. The use of ships built in China is likely to increase despite the Russian law that came into force in February 2018 requiring all vessels transporting Russian hydrocarbon resources on the NSR to be built in Russia.

It is difficult to predict how successful Russia will be in developing substitutes for other key technologies, industrial supplies, and logistics services previously provided by Western companies. China will likely attempt to fill these gaps by providing Russian industries with needed investments, technologies, and services68 to maintain the production and transport of Russian energy and mineral resources – as a substantial part of the export is headed for China anyway, at a substantial discount.

12. Conclusion

This study provides details on the vulnerabilities currently impacting the NSR’s maritime transportation system, both due to prior infrastructural deficiencies and more recently as the result of Western sanctions on Russia, and on the negative consequences or failures which may impact the transportation system in the coming years. The focus was on vulnerabilities that commonly occur with low frequency but have the potential to cause highly disruptive impacts when they do occur in maritime transportation systems. The overall analysis is based on a predetermined list of vulnerabilities determined to be most significant by a large group of maritime stakeholders. The key vulnerabilities discussed include the following: restricted access to supplies and quality materials; interruptions to the system’s internal operations; restrictions to transportation; limitations of communication and monitoring; a lack of suitable vessels; reduced financial flow; and limited access to personnel and high-quality logistics services. All of these vulnerabilities are currently impacting Russia’s Arctic energy development and the NSR maritime transportation system. Their cumulative impacts make the transport system less efficient and reliable and more prone to failure, impacting the safety of shipping and increasing the likelihood of pollution of the marine environment.

The impacts of these vulnerabilities have greatly increased as a result of Western technology and economic sanctions on Russia and the departure of Western companies from the Russian resource extractive industries. Western companies previously provided Russia with specialised equipment, technical supplies, support, and logistics services. Russia’s dependence on Western technology had been so significant that without the involvement of Western companies, extractive energy projects and the year-round shipping of commodities out of the remote Russian Arctic would likely not have been possible, and certainly could not have been developed so quickly. This cooperation led to a rapid industrial expansion never before witnessed in the Arctic.

Despite hefty sanctions from Western countries, Russia has continued with its development plans for the NSR and there is strong commitment to Arctic resource development and shipping along the NSR. The pace of Russian NSR development is likely to be greatly influenced by several factors in the coming years, not least the financial and human toll of the ongoing war between Russia and Ukraine and escalating geopolitical tensions, but also prevailing economic conditions and the technical capabilities of the Russian industries to support its planned resource development.

Russia will need to find suitable replacements for Western technology and services, including project investment. However, quickly replacing a large group of international companies that are world leaders in their respective fields and who have longstanding partnerships with Russian resource developers is in reality not feasible for Russia without lasting consequences. Meanwhile, the urgency of this technological transition away from Western companies is making Russia increasingly dependent on Chinese companies, which are likely to exert influence and control on Russian resource development. Chinese companies will likely try to fill the gap left by the departure of Western companies to promote the continuous production of Russian Arctic commodities for export to China.

Acknowledgements

The financial support by the Norwegian Ministry of Foreign Affairs’ ARCTIC 2030 project NOR-15/0010 is greatly appreciated. Mr. Sergey Balmasov and his team at CHNL’s Information Office is thanked for downloading of satellite AIS data from exactEarth and the management of CHNL’s Arctic Shipping Database used in this study.

Fotnoter

- 1 U.S. Department of Transportation. An Assessment of The U.S. Marine Transportation System – a Report to Congress. September 1999. https://www.maritime.dot.gov/sites/marad.dot.gov/files/docs/resources/2386/assessmntoftheusmts-rpttocongrsep1999combined.pdf

- 2 P. Tamvakis and Y. Xenidis (2012), “Resilience in transportation systems”, Transport Research Arena–Europe 2012, Procedia – Social and Behavioural Sciences, 48 (2012): 3441–3450; M. Omer, A. Mostashari, R. Nilchiani, and M. Mansouri, “A Framework for Assessing Resiliency of Maritime Transportation Systems”, Maritime Policy and Management, 39, no. 7 (2012): 685–703; Ø. Berle, B.J. Rice Jr., and B.E. Asbjørnslett, “Failure Modes in the Maritime Transportation System – A Functional Approach to Throughput Vulnerability”, Maritime Policy & Management 38, no. 6 (2011): 605–632; T-T. Nguyen, D.T. My Tran, T.T.H. Duc, and V.V. Thai, “Managing Disruptions in the Maritime Industry – A Systematic Literature Review”, Maritime Business Review (Emerald Publishing Limited, 2022); Ø. Berle, B.E. Asbjørnslett, and J.B. Rice Jr., “Formal Vulnerability Assessment of a Maritime Transportation System”, Reliability Engineering & System Safety, 96 (2011): 696–705.

- 3 B.E. Asbjørnslett and M. Rausand, “Assess the Vulnerability of Your Production System,” Production Planning and Control 10, no. 3 (1999): 219–229.

- 4 B. Gu and J. Liu, “A Systematic Review of Resilience in the Maritime Transport”, International Journal of Logistics Research & Applications (2023); G. Zsidisin and M. Henke, “Revisiting Supply Chain Risk,” in Revisiting Supply Chain Risk, eds. George Zsidisin and Michael Henke (Los Angeles: Springer International Publishing, 2019): 1–14.

- 5 Berle et al., “Failure Modes”, note 2.

- 6 B. Gunnarsson and F. Lasserre, “Supply Chain Control and Strategies to Reduce Operational Risk in Russian Extractive Industries Along the Northern Sea Route”, Arctic Review on Law and Politics, 14 (2023): 21–45.

- 7 Volpe National Transportation Systems Center, U.S. Department of Transportation, “Assessment of the Marine Transportation System (MTS) Challenges: Summary Report”, December 23, 2009, https://rosap.ntl.bts.gov/view/dot/5747

- 8 Previous studies on transportation infrastructure in the Arctic include: R.D. Brubaker and C.L. Ragner, “A Review of the International Northern Sea Route Program (INSROP) – 10 Years On”, Polar Geography 33 (2010): 15–38; Arctic Council, Protection of the Arctic Marine Environment (PAME), Arctic Marine Shipping Assessment Report 2009, 2009, https://oaarchive.arctic-council.org/bitstreams/cbb4cce2-3fbf-46f4-aede-2e3e01cd5e89/download

- 9 Charles Emmerson and Glada Lahn, Arctic Opening: Opportunity and Risk in the High North (London: Lloyd’s and Chatham House, 2012, https://assets.lloyds.com/assets/pdf-risk-reports-arctic-risk-report-webview/1/pdf-risk-reports-Arctic-Risk-Report-webview.pdf; E. Hill, M. Lanore, and S. Veronneau, “Northern Sea Route: An Overview of Transportation Risks, Safety and Security”, Journal of Transportation Security 8 (2015): 69–78.

- 10 Gunnarsson and Lasserre, “Supply Chain Control and Strategies”, note 6.

- 11 The Varandey oil terminal started production in 2008 and the Prirazlomnaya offshore platform in 2014, both in the Pechora Sea. The oil was shipped first to Murmansk for temporary storage before shipment to Europe.

- 12 Gunnarsson and Lasserre, note 6.

- 13 Federal Law of July 28, 2012, N 132-FZ “On Amendments to Certain Legislative Acts of the Russian Federation Concerning State Regulation of Merchant Shipping on the Water Area of the Northern Sea Route”. Accessed from http://www.nsra.ru/en/ofitsialnaya_informatsiya/zakon_o_smp.html

- 14 Viatcheslav V. Gavrilov, “Legal Status of the Northern Sea Route and Legislation of the Russian Federation: A Note,” Ocean Development & International Law, 46, no. 3 (2015): 256–263.

- 15 Paul Hopkin, Fundamentals of Risk Management (5th ed.), (London: Kogan Page, 2018).

- 16 Berle et al., “Failure Modes”, note 2.

- 17 The study by Berle et al. was based on surveys (525 respondents) and semi-structured interviews (16 interviewees) with terminal operators, port authorities, shippers, and coast guards in the United States and Panama.

- 18 Berle et al., “Failure Modes”, note 2.

- 19 Ukraine: EU agrees fifth package of restrictive measures against Russia, Brussels, April 8, 2022. file:///C:/Users/03209611/Downloads/Ukraine__EU_agrees_fifth_package_of_restrictive_measures_against_Russia.pdf

- 20 This included the following LNG plants: Yamal LNG; Arctic LNG-2; Sakhalin 2 LNG; LNG Floating Transshipment and Storage units (FSU) near Murmansk and on Kamchatka.

- 21 O. Serbian, D. Izmailova, A. Mashkin, and S. Glagoleva, “Assessment of the Reliability of the Development of Infrastructure Projects on Transport in the Russian Federation”, Transportation Research Procedia 68 (2023): 50–59; I. Popov, “Prospects of Development for Urban Areas in the Russian Arctic”, Sibirica, Interdisciplinary Journal of Siberian Studies 21, no. 1 (2022): 79–100.

- 22 “Arctic projects must not be postponed because of sanctions, Putin orders”, The Barents Observer, April 14, 2022. https://thebarentsobserver.com/en/arctic/2022/04/arctic-projects-must-not-be-postponed-because-sanctions-putin-orders

- 23 For the Arctic LNG-2 project, only a limited number of specialised gas turbines for refrigeration and power generation had been delivered before sanctions hit, resulting in only 50% production capacity of the first liquefaction train.

- 24 From the other BRICS countries (China, India, Brazil, South Africa, United Arab Emirates, Iran, Egypt and Ethiopia).

- 25 A. Moe, G. Heggelund, and K. Fürst, “Sino–Russian Cooperation in Arctic Maritime Development: Expectations and Contradictions”, Europe–Asia Studies, (June 2023).

- 26 C.Y. Liu, H.M. Fan, X.J. Dang, and X. Zhang, “The Arctic Policy and Port Development along the Northern Sea Route: Evidence from Russia’s Arctic Strategy”, Ocean & Coastal Management, 201 (2021): 105422.

- 27 Gunnarsson and Lasserre, note 6.

- 28 A fire at the Melkøya LNG plant in Hammerfest, Norway caused a shut-down of all plant operations for a full year, between September 2020 and October 2021.

- 29 A. Afonin, E. Olkhovik, and A. Tezikov, “Conventional and Deep-Water Shipping Passages Along the Northern Sea Route”, in V. Erokhin, T. Gao and Zhang (Eds.), Handbook of Research on International Collaboration, Economic Development, and Sustainability in the Arctic (Hershey, PA: IGI Global, 2019): 314–337; Belkin, M., “Improvement of the icebreaking capacity to guarantee year-round navigation via the Northern Sea Route”, PowerPoint presentation, International Arctic Shipping Seminar, December 12, 2019, Busan, South Korea.

- 30 The average water depth of Ob Bay is 10–12 metres; some parts are only 2–3 metres deep. The only navigable shipping channel in the upper part of the bay, leading to the port of Sabetta and the Yamal LNG, is 25 km long, 300 m wide, and 15 m deep, navigated by vessels which are up to 50 m wide, 300 m long and with a draft of 12 m (referred to as “Yamalmax” dimensions). The extended channel to the Utrenniy terminal being dredged as part of the Arctic LNG-2 project is planned to be 5.6 km long, 510 meter wide, and 15 m deep.

- 31 H. Kubny, “Problematic changes in the Gulf of Ob?”, Polar Journal, September 9, 2020.

- 32 European dredging companies from Belgium and the Netherlands. In 2021 there were 12 European dredgers working in Ob Bay (9,000–26,500 deadweight tonnes or dwt). The same year there were also 11 Russian dredgers (1,000–4,000 dwt) in Ob Bay, the White Sea (Arkhangelsk) and Sever Bay on the Taimyr Peninsula. In 2022, there were only 7 Russian dredgers working on the NSR.

- 33 The development of the Northern Sea Route requires the creation of a productive dredging fleet (translated from Russian), February 16, 2023. Для развития Севморпути требуется создание производительного дноуглубительного флота (rosatomport.ru)

- 34 The Sever Bay terminal of the Vostok Oil megaproject and Syradasayskoye coal terminal.

- 35 I. Popov, “Prospects of Development for Urban Areas in the Russian Arctic”, note 21.

- 36 D. A. Streletskiy, L. J. Suter, N. I. Shiklomanov, B. N. Porfiriev, and D. O. Eliseev, “Assessment of Climate Change Impacts on Buildings, Structures, and Infrastructure in the Russian Regions on Permafrost”, Environmental Research Letters 14 (2019): 025003.

- 37 I. Popov, “Prospects of Development for Urban Areas in the Russian Arctic”, note 21.

- 38 I. E. Frolov, “Development of the Russian Arctic Zone: Challenges Facing the Renovation of Transport and Military Infrastructure”, Studies on Russian Economic Development 26, no. 6 (2015): 561–566.

- 39 The port of Pevek got an upgrade due to the arrival of a floating nuclear power plant in 2019.

- 40 Jean-Paul Rodrigue, The Geography of Transport Systems (New York: Routledge, 2020).

- 41 Gunnarsson and Lasserre, note 6.

- 42 The Kara Sea, the Ob Bay, Yenisei Bay and Yenisei River to Dudinka.

- 43 T. Solakivi, T. Kiiski, and L. Ojala, “The Impact of Ice Class on the Economics of Wet and Dry Bulk Shipping in the Arctic Waters”, Marine Policy & Management (2018), https://doi.org/10.1080/03088839.2018.1443226

- 44 B. Gunnarsson and A. Moe, “Ten Years of International Shipping on the Northern Sea Route: Trends and Challenges”, Arctic Review on Law and Politics, 12 (2021): 4–30.

- 45 Only one cellular container ship has sailed between Europe-Asia via the NSR so far. This was the maiden voyage of the 3,600 TEU and A1 (Arc4) ice-class Venta Maersk in September 2018 from South Korea to Germany, built for winter operations in the Baltic Sea. Right after the voyage, Maersk announced that the company would not be interested in starting container shipping on the NSR.

- 46 Aker Arctic, Introducing an Icebreaking Arctic Container Ship, 2021. https://akerarctic.fi/app/uploads/2021/03/Passion_news_2021_nro_01_4_introducing-an_s14-15.pdf

- 47 Relative cost of construction: Conventional vessel (100%); Arc4-5 vessel 110–130%; and Arc7-8 vessel 300–400%.

- 48 The State Council Information Office of the People’s Republic of China, “China’s Arctic Policy”, January 2018. https://english.www.gov.cn/archive/white_paper/2018/01/26/content_281476026660336.htm

- 49 A. Bambulyak and S. Ehlers, “Oil Spill Damage: A Collision Scenario and Financial Liability Estimations for the Northern Sea Route Area”, Ship Technology Research, 67, no. 3 (2020).

- 50 Malte Humpert, “Lacking Own Satellite Coverage Russia is Looking to China for Northern Sea Route Data”, High North News, March 30, 2023. Lacking Own Satellite Coverage Russia Is Looking to China For Northern Sea Route Data (highnorthnews.com)

- 51 Nikk Ogasa, “Cyclones in the Arctic Are Becoming More Intense and Frequent”, ScienceNews, January 17, 2023. Cyclones in the Arctic are becoming more intense and frequent (sciencenews.org)

- 52 A.G. Egorov, “The Russian Arctic Sea Ice Age Composition and Thickness Variation in Winter Periods at the Beginning of the 21st Century”, Arctic and Antarctic Research 66, no. 2 (2020): 124–143 (in Russian with English abstract), https://doi.org/10.30758/0555-2648-2020-66-2-124-143

- 53 E. Svintsova, “24 Vessels Were Trapped in Ice on the Northern Sea Route”, Neftegaz.ru, November 22, 2021. 24 судна оказались в ледовом плену на СМП (ampproject.org) (translated from Russian)

- 54 Arctic and Antarctic Research Institute (AARI), Operational Data 1997–2024, Arctic Ocean Ice Charts and Regional Ice Charts. ESIMO AARI • Overview ice maps of SLO

- 55 Thomas Nilsen, “FSB Signs Maritime Security Cooperation with China in Murmansk”, The Barents Observer, April 25, 2023. FSB signs maritime security cooperation with China in Murmansk | The Independent Barents Observer (thebarentsobserver.com)

- 56 Astri Edvardsen, “Taking Network Coverage in the Arctic to New Heights”, High North News, September 23, 2022. Taking Network Coverage in the Arctic to New Heights (highnorthnews.com)

- 57 J. Vanhatalo, J. Huuhtanen, M. Bergström, I. Helle, J. Mäkinen, P. Kujala, “Probability of a Ship Becoming Beset in Ice along the Northern Sea Route – A Bayesian Analysis of Real-life Data”, Cold Regions Science and Technology 184 (April 2021): 103238.

- 58 A. Moe, “A New Russian Policy for the Northern Sea Route? State Interests, Key Stakeholders, and Economic Opportunities in Changing Times”, The Polar Journal 10, no. 2 (2020): 209–227; foreign LNG and gas condensate tankers on long-term charter contracts with the Yamal LNG that had been established before February 2018 were exempt from this ruling.

- 59 A. Bambulyak and S. Ehlers, “Oil Spill Damage: A Collision Scenario and Financial Liability Estimations for the Northern Sea Route Area”, note 51.

- 60 I. Popov, “Prospects of Development for Urban Areas in the Russian Arctic”, Sibirica, Interdisciplinary Journal of Siberian Studies 21, no. 1 (2022): 79–100.; D. Gritsenko and E. Efimova, “Policy Environment Analysis for Arctic Seaport Development: The Case of Sabetta (Russia)”, Polar Geography 40, no. 3 (2017): 186–207.

- 61 Atle Staalesen, “Thousands of Workers Stuck in Remote Arctic Construction Sites”, March 26, 2020, The Barents Observer. https://thebarentsobserver.com/en/2020/03/thousands-workers-stuck-remote-arctic-construction-sites

- 62 U.S. Department of State, Imposing Further Sanctions in Response to Russia’s Illegal War Against Ukraine, September 14, 2023, Imposing Further Sanctions in Response to Russia’s Illegal War Against Ukraine – United States Department of State

- 63 France’s TotalEnergies (10%), China’s state-owned oil major CNOOC (10%), China’s National Petroleum Corp. (CNPC; 10%), and Japan’s consortium Mitsui/JOGMEC (10%).

- 64 Gunnarsson and Lasserre, note 6.

- 65 Morgan Chittum, “Russia Is Undergoing ‘Reverse Industrialization’ as Limited Resources Force a Retreat from High Tech Industries, Finland’s Central Bank Says”, June 2, 2023. https://markets.businessinsider.com/news/currencies/russia-economy-ukraine-war-tech-reverse-industrialization-central-bank-finland-2023-3

- 66 Government of the Russian Federation, “Amendments to the Fundamentals of State Policy in the Arctic to 2023”, February 21, 2023. Translated from Russian Внесены изменения в Основы государственной политики в Арктике на период до 2035 года • Президент России (kremlin.ru).

- 67 Government of the Russian Federation, “Updated Version of the Russian Foreign Policy Concept”, March 31, 2023. Translated from Russian Указ об утверждении Концепции внешней политики Российской Федерации • Президент России (kremlin.ru)

- 68 G. Tianming and V. Erokhin, “China–Russia Collaboration in Shipping and Marine Engineering as One of the Key Factors of Secure Navigation along the NSR”, Arctic Yearbook 2019: Redefining Arctic Security (2019): 234–263.